Performance and outlooks

€12,011 mln

NET SALES FROM OPERATIONS

€4,707 mln

NET DEBT

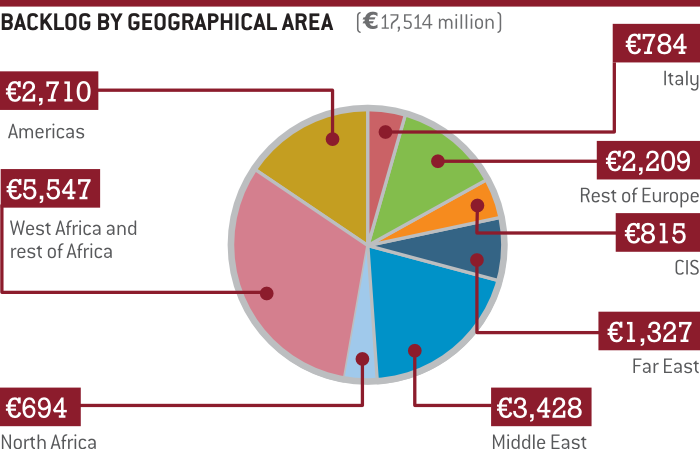

€17,514 mln

TOTAL BACKLOG

(€404) mln

NET PROFIT

€ 908 mln

Capital expenditure

(€98) mln

Operating profit

Saipem in numbers

Overall, compared to 2012, 2013 revenues decreased by 10.2% and EBITDA by 71.8%, while the year saw the Company post a negative net result of €404 million. The main causes of this significant deterioration in results included completion of a number of high margin contracts, the subsequent increase in the incidence of low-margin contracts acquired in previous years, and delays in important contract awards. In addition, a worsening of commercial relations in Algeria in the wake of investigations conducted by the Algerian authorities, coupled with critical issues that emerged in relation to projects under execution in Mexico and Canada and, finally, completion works on a vessel, had a further negative impact on results.

The Company’s share price, which lost 49% of its value over the course of 2013, was impacted at the beginning of the year by the announcement of a sharp downward revision of 2013 earnings guidance. This caused the share price to fall to €19.90. Subsequently, after a second downward revision of guidance in mid-June caused another sharp drop to a yearly low of €12.60, the Saipem stock closed out 2013 at a price of €15.54.

Capital expenditure in 2013 amounted to €908 million. The most significant investments were in the Castorone, the new pipelay vessel which began operations in the second quarter; class reinstatement works on the semi-submersible rigs Scarabeo 5 and Scarabeo 7 and the jack-up Perro Negro 3; and final completion works on four new rigs scheduled for operations in Saudi Arabia. Construction work continued on the Guarujà yard in Brazil, and the new fabrication yard in Edmonton Canada was opened during the last quarter of the year.

There has been an 11% reduction in backlog, mainly due to a partial downturn in the market and a delay in the awarding of some important contracts, all of which has had an impact on revenues and acquisitions. There have also been some removals from the backlog: €795 mln from the sale of the FPSO Firenze and €72 mln due to the loss of the PN6. However, our commercial activity has not ceased. In 2013 Saipem participated in numerous bids and in many cases the Company is in an advanced stage of negotiations with Clients.

Future outlooks and goals

2014 is expected to be a year of transition with a return to profitability. Thanks to the contribution of all businesses, Saipem expects EBIT to be between €600 and €750 million, and net profit to be positive, hence a robust recovery. The commercial market outlook remains encouraging, with a large number of contracts on the verge of being awarded in the near future and for which Saipem is in a solid competitive position. These include pipe-laying projects in ultra-deep waters, subsea developments in deep and ultra-deep waters, FPSO construction projects and large onshore projects featuring a high level of technological complexity.

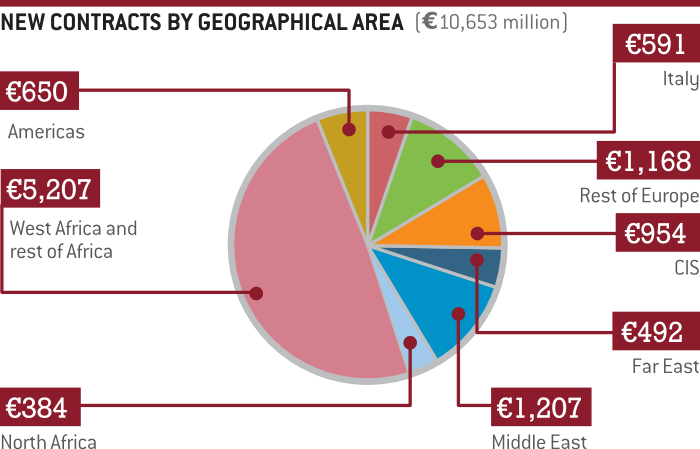

Note: New contracts awarded to the Saipem Group in 2013 amounted to €10,653 million (€13,391 million in 2012).

54% of all contracts awarded were in the Offshore Engineering & Construction sector, 24% in the Onshore Engineering & Construction sector, 13% in the Offshore Drilling sector and 9% in the Onshore Drilling sector.